Top Car Accident Attorneys in NJ

![]() If you or someone you love was hurt or suffered loss in an NJ car accident that was caused by someone else, the law could be on your side.

If you or someone you love was hurt or suffered loss in an NJ car accident that was caused by someone else, the law could be on your side.

Obtaining compensation and achieving justice is very important for car accident victims, so fight for what you deserve with the help of an experienced accident lawyer.

Can You Sue For a Car Accident in New Jersey?

Pursuing legal action may sound daunting, but you should consider filing a car accident lawsuit to protect your best interests. Without filing a proper car accident claim, the insurance company may refuse to pay you the true amount you are entitled to (or any amount at all) and you may be left facing the costs of your injuries by yourself.

Note that pursuing a personal injury claim does not necessarily mean having to go to court. In fact, most New Jersey auto accident cases are settled outside the courtroom. Do not be afraid to fight the insurance companies for what you deserve. An experienced NJ accident lawyer can help you succeed with your claim and get full and fair compensation for your injuries and other damages.

Why Choose The Grossman Law Firm For Your New Jersey Car Accident Injury Claim?

Winning experience

Winning experience

Put our experience to work for you. Our car accident lawyers have over 100 years of combined experience dealing with auto injury cases in New Jersey. We have successfully represented clients in both central and northern New Jersey who have suffered physical, financial and emotional pain because of the negligence of others.

No fee unless you win

This is our guarantee: You won’t have to pay us any fee unless we win. You get high-quality legal representation without having to take out money from your pocket until you get compensation.

Full commitment to you

As a personal injury client, you will receive professional, compassionate, and aggressive representation. We pride ourselves in our responsiveness to our clients and we make sure every client is treated as an individual and never as another file.

Fearless representation

Do not worry about facing large insurance companies. Our skilled lawyers are backed by the support of an expert legal team who knows how to take on even the most powerful insurance carriers in the country.

We care about your situation and understand the harm you’ve encountered and the stress you may be going through. Your consultation with us is completely free of charge. Tell us about your New Jersey car accident by calling (732) 625-9494 today.

Car Accidents

The law of negligence generally governs compensation claims that arise from car accidents. People operating motorized vehicles have a duty to exercise reasonable care under the circumstances. When drivers fail to use reasonable care, they are deemed negligent by the law. When negligent drivers cause injuries to others, they may be required by law to compensate the injured victims for the losses they incurred.

Motorcyclists have the same legal rights on roadways as drivers of trucks, passenger cars, and other vehicles. Unfortunately, most insurance companies in Union County, New Jersey have negative attitudes toward motorcycle riders and tend to consider them negligent. It’s important for injured motorcyclists to get the help of a lawyer who has a deep understanding of the unique issues involved in motorcycle accidents.

Fatigued truck drivers, poorly maintained big rigs, and busy highways make up a recipe for a tragic road disaster. Truck accidents have long been the most significant dangers to the safety of motorists and pedestrians. Due to the importance of trucks in the transportation of goods, big rigs are here to stay and people have to deal with them. While the trucking industry is heavily regulated, there are many ways for trucks to cause serious and fatal accidents.

What Type Of Car Accident Were You Injured In?

As a car accident victim there are various motor vehicle crash types, and some are more complicated than others. No matter how complex your accident was or the size of the insurance company you’re up against, we have the skills and experience to help you.

As a car accident victim there are various motor vehicle crash types, and some are more complicated than others. No matter how complex your accident was or the size of the insurance company you’re up against, we have the skills and experience to help you.

We have successfully handled a variety of car crash types, including (but not limited to):

Rear-end collisions

This type of crash happens when a vehicle behind you hits the back end of your car.

Head-on collisions

When the front ends of two vehicles collide, the resulting injuries can be particularly serious and even fatal.

Side-impact collisions (T-bone or broadside)

This is the car accident type that occurs when the side of your car is hit by another vehicle.

Rollover accidents

These highly fatal crashes are typical among SUVs and other taller cars, as they have more tendency to tip onto their side or their roof.

Single-car accidents

If your car is the only vehicle involved – for example, if you crashed into a fire hydrant or a wall – you may be wondering if it was your fault. Talk to us first to make sense of your accident.

Multi-vehicle wrecks (pileups)

When three or more vehicles are involved in motor vehicle accidents, determining fault and liability can be difficult, but we can get to the bottom of it to identify the responsible parties.

Commercial vehicles

Crash involving large vehicles such as 18-wheelers, tractor trailers, semi-trucks, delivery vans, buses, tankers, cement trucks, dump trucks etc… are more complicated due to the nature of the accident and due to the fact that often company of the commercial vehicle driver will likely have their own legal team behind them.

We take on even the toughest car accidents. Our car accident lawyers are proficient in researching, gathering evidence, building strategies, and negotiating to get you the car accident victim top compensation regardless of what type of car crash injured you.

What Caused Your Auto Accident in New Jersey?

Unfortunately, no matter how safely you drive, there is always the possibility that someone else will be negligent enough to cause an accident. Negligence is an essential element in any injury claim, so consult with us to see the legal steps you can take against the at-fault party.

Unfortunately, no matter how safely you drive, there is always the possibility that someone else will be negligent enough to cause an accident. Negligence is an essential element in any injury claim, so consult with us to see the legal steps you can take against the at-fault party.

Here are some of the most common causes of vehicle crashes:

Were you hit by a vehicle that was going too fast?

Excessive speed often leads to more serious injuries.

Distracted driving

Many drivers today are distracted by their mobile phones or other devices while on the road.

Drunk driving or driving under the influence

This could involve intoxication by alcohol or by drugs.

Unsafe roads

Lack of road maintenance, defective road design, lack of traffic signs, and the presence of road hazards are some factors that make a motorway particularly unsafe.

Defective vehicle parts

Malfunctioning brakes and defective airbags are common examples of these.

Poorly maintained vehicle

A vehicle that isn’t well-tuned can cause larger problems on the road – for example, by suddenly breaking down in the middle of the street, resulting in a collision.

In most of these cases, someone may be held liable. While it is commonly a driver who is at fault, other parties such as vehicle manufacturers and even public agencies may be responsible, too. Our motor vehicle accident attorneys can help you pinpoint where the fault lies and identify the best course of action to move forward.

The Grossman Auto Accident Law Firm, LLC is proud to serve clients throughout New Jersey in counties such as (but not limited to): Atlantic County, Bergen County, Burlington County, Camden County, Cape May County, Cumberland County, Essex County, Gloucester County, Hudson County, Hunterdon County, Monmouth County, Middlesex County, Morris County, Ocean County, Passaic County, Mercer County, Salem County, Summerset County, Sussex County, Union County, Warren County and beyond.

Grossman Law Firm also serves automobile accident clients in localities such as Freehold Township, Edison, Plainsboro, Woodbridge Township, Lakewood Township, Toms River, Hamilton Township, Trenton, Brick, Middletown, Old Bridge, Piscataway, New Brunswick, Jackson, Howell Township, Perth Amboy, East Brunswick, South Brunswick, North Brunswick, Marlboro, Monroe, Manalapan, Red Bank, Neptune, and more!

How Bad Are Your Injuries?

New Jersey car accident injuries are often serious and even life-threatening, they can lead to serious injuries and disfigurement. It is best not to take them lightly, even if they seem very minor. Some vehicle injuries don’t even manifest themselves until weeks after the motor vehicle accident, so don’t dismiss a seemingly simple bruise or any slight ache.

New Jersey car accident injuries are often serious and even life-threatening, they can lead to serious injuries and disfigurement. It is best not to take them lightly, even if they seem very minor. Some vehicle injuries don’t even manifest themselves until weeks after the motor vehicle accident, so don’t dismiss a seemingly simple bruise or any slight ache.

Serious car crash injuries include:

- Traumatic brain injury

- Neck and spine injury

- Chest injury

- Fractures or broken bones

- Internal organ damage

- Joint injury

These injuries often involve costly medical bills, pain and suffering, emotional distress, and lost wages. Many auto accident victims in NJ also require long-term care and ongoing therapy. In other words, accident injuries can have a huge (and sometimes permanent) impact on your life

Your first priority after a New Jersey car wreck should be to seek professional medical attention to make sure that all your injuries are detected and treated. Don’t avoid getting a doctor’s appointment just because of the potential medical bills and expenses – your NJ car accident lawyer from the Grossman Law Firm will give you options and will aggressively fight for you to get compensated for the costs of your injuries.

Sobering New Jersey Fatality Statistics

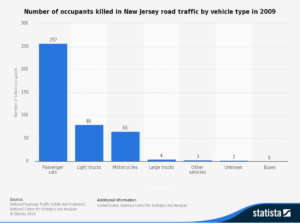

According to New Jersey road traffic accident statistics, in 2009 the most fatalities occurred in passenger vehicles, followed by light trucks, then motorcycles closely behind. Large truck accidents, such as semi-trucks, 18-wheelers, big rigs, tractor trailers and other large commercial vehicles resulted in the lowest number of fatalities. While large commercial vehicles resulted in the least amount of fatalities injuries from large trucks are often much more serious than regular passenger cars or light trucks.

According to New Jersey road traffic accident statistics, in 2009 the most fatalities occurred in passenger vehicles, followed by light trucks, then motorcycles closely behind. Large truck accidents, such as semi-trucks, 18-wheelers, big rigs, tractor trailers and other large commercial vehicles resulted in the lowest number of fatalities. While large commercial vehicles resulted in the least amount of fatalities injuries from large trucks are often much more serious than regular passenger cars or light trucks.

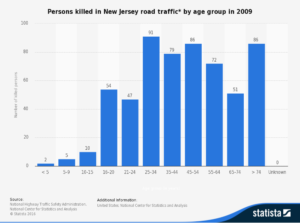

Age seems to also play are role in NJ auto accident fatalities with the highest number of victims being in the age range of 25-35, tied for the second highest number of groups killed are ages 45-54 and 74+. Surprisingly the lowest numbers of fatalities in 2009 were for the 21-24 and the 65-74 age groups.

Age seems to also play are role in NJ auto accident fatalities with the highest number of victims being in the age range of 25-35, tied for the second highest number of groups killed are ages 45-54 and 74+. Surprisingly the lowest numbers of fatalities in 2009 were for the 21-24 and the 65-74 age groups.

Tragically there was a significant number of children killed as well.

NJ Car Accident Laws And How They Can Work For You

New Jersey has several laws that apply when you get injured in an accident. Having a basic awareness of these laws is a good first step.

New Jersey has several laws that apply when you get injured in an accident. Having a basic awareness of these laws is a good first step.

What are the auto insurance requirements in NJ?

Standard insurance policy limits in New Jersey are a minimum of $15,000 in bodily injury liability coverage, a minimum of $5,000 property damage liability coverage and a minimum of $15,000 personal injury protection (PIP) coverage. But even if your insurance policy, as well as the other driver’s, can cover your accident costs, getting money beyond property damage won’t be easy. You’ll have to gather evidence for your claim and negotiate with the insurance provider. You may also face tough decisions related to the insurance companies like accepting settlements or going to trial.

Is NJ a no fault state for car accidents?

When it comes to car accident insurance, NJ is a no-fault state. This means that regardless of who was at fault in the accident, your own insurer will be the one to pay you. This is why your auto insurance policy includes a personal injury protection (PIP) coverage. However, this rule may not apply if your injuries are considered serious.

Is New Jersey a comparative negligence state?

Legally called the modified Comparative Negligence law, this New Jersey law states that the amount of compensation you may receive will be reduced according to how much fault you contributed to the accident. Further, if you had more than 50 percent of the fault, you won’t be able to collect anything at all from the other parties. New Jersey insurance adjusters often cite this rule during settlement talks, so make sure you have a knowledgeable attorney to protect you.

Do I Need To Report the Accident to Police?

In a New Jersey car accident where someone was hurt or a vehicle was badly damaged, you are legally obligated to report the incident to the police. File an accident report as soon as you can. This report will also serve as a valuable evidence once you make an accident claim. Also after an accident if you are able to gather pictures, names witnesses and other records or evidence it will help your case.

How Long After a Car Accident Can You Sue in New Jersey?

The New Jersey statute of limitations for auto accidents is 2 years. This is the law that sets a deadline for those who are pursuing a car accident lawsuit. If you wish to sue someone for your injuries, you have two years from the date of injury to file a personal injury lawsuit. After two years, the NJ court system will likely refuse to hear you. There is also a deadline for filing a written claim, so the sooner you take action, the better.

The best way to make these laws work for you is by consulting an injury attorney right after your accident. One of our experienced New Jersey car accident lawyers can protect your rights, stand up to insurance companies, and build you an effective and robust case. It is important to call us immediately, as any delay can hurt your claim.

Other New Jersey Car Accident Facts And Figures

Auto accidents occur by the thousands across the country each year, and many of these happen in New Jersey. These accidents are often injurious and many are fatal.

Auto accidents occur by the thousands across the country each year, and many of these happen in New Jersey. These accidents are often injurious and many are fatal.

According to the latest report from the National Highway Traffic Safety Administration (NHTSA), 96 percent of all vehicles involved in traffic accidents in 2014 were passenger vehicles. That’s 10,165,000 cars, SUVs, pickup trucks, and vans. In the same year, 21,022 people died from passenger vehicle crashes, while 2.07 million were injured. Passenger car occupants made up 57 percent of the fatalities and 62 percent of the injured victims.

New Jersey has over 37,000 miles of public roads. The NJ Department of Transportation reports that in 2014, a total of 290,212 traffic accidents occurred statewide. Of these, 521 were fatal crashes and 59,408 were injury crashes. The counties of Bergen, Middlesex, and Essex were the three counties with the most number of traffic accidents that year. Although other counties such as Monmouth County, had significant numbers as well.

These statistics are frightening despite state-of-the-art air bags, recent laws enacted to require the wearing of seatbelts, and the use of hands-free cell phones.

Accidents happen, and when they do, the potential for devastation is great. No matter how common car crashes are, each incident is largely personal, creating a huge financial and emotional burden for the individuals involved.

When such a misfortune has happened to you, you don’t want your case to be treated as just another statistic. You need personal attention and commitment. This is exactly the kind of legal service we provide, making us the firm that numerous clients trust.

If you or a loved one has been injured in a motor vehicle accident simply call us at (732) 625-9494 for a free consultation and case evaluation.

What Should I Do After a Car Accident in New Jersey?

An auto accident can leave you disoriented and anxious, but it’s important to stay calm. There are things you need to remember in the aftermath, for you to succeed in pursuing your case:

An auto accident can leave you disoriented and anxious, but it’s important to stay calm. There are things you need to remember in the aftermath, for you to succeed in pursuing your case:

File a report

If you haven’t already called the police about your accident, now is the time to do it. Don’t wait too long before filing your accident report – this is a vital piece of documentation to support your claim, and any delay could be taken against your case.

Don’t admit fault

Accidents are often confusing, and sometimes, you may think you were to blame. Don’t say a word before you have an attorney to speak for you. Don’t even apologize. Any admission of fault can badly hurt you and reduce your chances of getting compensated.

Don’t accept a first offer

The insurance company will likely get in touch with you very soon after your car accident, offering you a certain amount of money. But insurers are known to employ tactics that benefit them, not you. Many injury victims make the mistake of settling with a first offer, not realizing this is far less than the amount they deserve. Never settle for anything until you have your attorney’s guidance.

Call a lawyer immediately

From the moment right after the accident, there are many ways you could be threatened. An experienced lawyer ensures this doesn’t happen, guiding you on the right steps to take and protecting you from parties that could take advantage of you.

In all of these, it is best to act promptly and without delay, as many aspects of a personal injury lawsuit are time-sensitive. If you have any doubts or questions, always consult with a trustworthy lawyer first. Get a free consultation – just call us at (732) 625-9494.

How Do I Choose An Attorney For An Accident In New Jersey?

Below are 3 things you should look for when choosing a lawyer to represent you in your accident claim.

- Skilled representation in insurance negotiations. When facing an auto insurance company, you don’t have to go it alone. In fact, it’s best to have a lawyer to represent you – one who knows how insurers work and who will aggressively pursue compensation against the at-fault party and their insurance carrier. We can provide this for you.

- Professional representation in arbitration. When the insurance company refuses to pay the costs of the medical treatment you need, we don’t just give up on the case. We will represent you in arbitration proceedings before the National Arbitration Forum against the auto insurance company responsible for paying your medical bills. We provide these services at no cost to you.

- Competent representation in court. If you decide to take your case to court and file a lawsuit, our firm can proficiently handle your case and fight for a verdict that favors you.

Throughout your car accident case, The Grossman Law Firm is committed to providing you with consistent communication, plain-language answers, and compassionate understanding of your situation. Car accident victims throughout New Jersey have trusted The Grossman Law Firm for over 25 years to get them results!

- You won’t have to be anxious about how your case is moving along – we’ll regularly update you.

- If you have concerns and questions, you can ask us directly. We’ll respond with clear answers without the confusing legal jargon.

- If your condition is severe and you can’t travel, we will travel to you or arrange for transportation if needed.

- We’re prepared to help you with your other needs pertaining to the case, whether it’s translation services for your appointment or a doctor for your treatment.

How much does a personal injury lawyer cost in New Jersey?

At the Grossman Law Firm you don’t worry about lawyer fees. We represent our clients on a contingency basis, so you’ll only have to pay us based on a percentage of the recovery from your settlement or verdict of the case. Your consultations with us are also free.

Top-quality legal service focused on your specific case – that’s what you get when you entrust your case to us. It’s the kind of service that has won many car accident cases throughout New Jersey, helping numerous individuals recover from their injuries and get back on track with their lives.

Let’s get started with your case. Here are some quick answers to questions you may be asking about car accidents and injuries.

How much money will I be able to claim after my accident?

Car accident compensation varies widely depending on several factors, such as the circumstances leading to the crash and the severity of the resulting injuries. Each case is specific, so the only way you can determine how much your case is worth is by talking it over with an attorney. These are only some of the damages you may be entitled to:

- Cost of medical treatment

- Cost of therapy or long-term care

- Lost wages

- Pain and suffering

- Emotional distress

What if the at-fault driver has no insurance or has inadequate insurance?

If the driver who hit you is uninsured or underinsured, your own insurance provider should take care of your medical bills if you have standard policy. Thus, you will need to file your claim with your own insurer. The amount you can receive is still subject to negotiation, so it is best to be represented by a car accident attorney.

What if I was partially at fault for the accident?

Under New Jersey’s comparative negligence law, your compensation may be reduced according to how much you were at fault. However, you should be very careful about admitting your fault to anyone especially to an insurance adjuster. Let your attorney speak for you instead.

Can I negotiate with the insurance company myself?

You can, but this is not recommended. In fact, it is a mistake that many accident victims make. Don’t be fooled by the pleasant nature of insurance adjusters… they have been trained in various tactics to undermine how much your injuries are really worth. Even your innocent remarks may be used against you to reduce your claim. Hiring an NJ accident lawyer to represent you in insurance negotiations is your best option to receive what you truly deserve.

What legal actions can I take if a loved one died in the accident?

If the death of your family member or partner was caused by someone else’s negligent actions, you may have a wrongful death case. You may make a wrongful death claim or pursue the case in court. Talk to your lawyer about the best course of action to take.

If you have any other questions at all about your accident, we are ready to provide you with specific answers. Please feel free to call us so we can discuss your case.

Free Consultation & Case Evaluation – Talk To Us Today

If you or a loved one has been injured in a victim of an auto accident anywhere in New Jersey and have suffered injuries or even the death of a family member, please contact an accident lawyer today. Consultations are always free and confidential.

Frequently Asked Questions on New Jersey Car Accidents

If you or someone in your family has been hurt in an auto accident in NJ, you likely have many questions about what to do and how to get compensation. Find the answers to common accident questions below.

What should I do after a car accident in New Jersey?

Immediately after a car crash, these are the steps to take:

- Call 911 and get medical attention for any injuries you have, even minor-looking ones.

- Report the accident to the police and obtain a copy of your accident report.

- Call a personal injury lawyer to protect your rights from the get-go.

- Exchange contact details and insurance information with the other driver, but avoid making any statements or apologizing.

- Document the accident scene by taking photographs or videos.

- Notify your auto insurance company about the accident, but consult with your lawyer first about what to say to the insurer.

- Avoid posting about the accident and your health condition on social media.

What type of NJ auto insurance policy do I have?

First, let’s look at the types of coverages that an NJ auto insurance policy may have:

- Personal injury protection (PIP) – New Jersey is a no-fault state, which means your insurance will cover your expenses first regardless of who was at fault in the crash. Your PIP coverage is the one that covers your medical bills, lost wages, and certain other monetary losses up to the limit. PIP is mandatory in New Jersey.

- Liability coverage – If you were the one who caused an accident, this coverage pays for the other party’s bodily injury and property damage. This is also mandatory coverage in NJ.

- Uninsured/Underinsured motorist coverage (UM/UIM) – In NJ, UM/UIM is an optional coverage that would pay for your losses if the at-fault party is uninsured or has insufficient insurance or if the at-fault driver fled the scene (hit-and-run). This applies if you’ve used up your PIP coverage and need additional reimbursement from the at-fault party.

- Collision coverage – This optional coverage pays for the damage on your vehicle after a crash, regardless of who was at fault.

- Comprehensive coverage – This pays for vehicle damage not caused by a crash. Examples are vandalism, flood, hail, fire, falling objects, and theft. This is also an optional coverage in NJ.

When you purchase auto insurance in New Jersey, you can choose from two types of policies, which dictate the coverages and coverage limits you can have:

- Basic auto insurance:

-

- PIP coverage – From $15,000 to $250,000 per person covered

- Liability coverage – $5,000 for property damage and optional $10,000 for bodily injury liability

- UM/UIM – Not available

- Collision coverage – Available as an option from some insurers

- Comprehensive coverage – Available as an option from some insurers.

- Standard auto insurance

- PIP coverage – From $15,000 to $250,000 or more per person covered

- Liability coverage – $15,000-$30,000 per-person bodily injury liability, and $5,000-$100,000 property damage liability

- UM/UIM – Available as an option

- Collision coverage – Available as an option

- Comprehensive coverage – Available as an option.

Does health insurance cover auto accident injuries in NJ?

This depends on your specific health care policy. While many health insurance policies do cover accidents, some exclude them. Check your health plan’s terms and exclusions.

New Jersey allows you to choose between your PIP and your health insurance as your primary provider in the event of auto accident injuries. When you select one as primary coverage, the other will become the secondary coverage that would kick in if you exhaust the first one. Read our quick guide on how to choose between PIP and health insurance for your accident injury medical care.

Can you sue for a car accident in New Jersey?

If you’ve exhausted your PIP coverage and need additional compensation, it may be possible to sue the at-fault party. However, your ability to file a lawsuit depends on whether or not your auto insurance allows it.

An auto insurance policy in NJ can be either full tort or limited tort. A full tort policy has “No Threshold” on lawsuits, which means you may sue the at-fault driver regardless of the kind of injuries you have. On the other hand, a limited tort policy has a “Limitation on Lawsuit Threshold.” Under this, you cannot file an injury lawsuit unless your injury meets the threshold for “serious injuries.”

In New Jersey, only the following are “serious injuries”:

- Displaced fracture

- Loss of a limb

- Serious scarring or disfigurement

- Loss of a fetus

- Permanent injury (requires doctor’s certification)

- Death.

In short, if the insurance policy you purchased was full tort (No Threshold), you can likely sue the other driver. But if your policy is limited tort (with Limitation on Lawsuit Threshold), your ability to sue is significantly restricted. Speak with a personal injury attorney to determine your best options, given your insurance policy.

How long after a car accident can you sue in New Jersey?

Under New Jersey’s Statute of Limitations for car accidents, you generally have two years to file a personal injury lawsuit, starting from the date of the crash.

If a loved one died due to the accident and you are filing a wrongful death lawsuit, the two-year period starts on the date of the death, which is not necessarily the same as the crash date.

A few exceptions apply to these rules. For example, if you were underage at the time of the crash, your two-year period to sue starts on the day of your 18th birthday.

Missing these deadlines would mean you have waived your right to sue, and the court will likely dismiss your case.

Do you need a lawyer after a New Jersey auto accident?

The law doesn’t require you to have an attorney when making an accident claim, but many claimants find that they need one anyway. A 2017 survey by Martindale-Nolo Research showed that, on average, injury claimants represented by a lawyer obtained $60,000 more compensation than those who didn’t have a lawyer.

Insurance companies are known to undermine injury claims, especially if the claimant has no legal representation. Insurance adjusters could use tactics such as “delay, deny, defend” to minimize the claimant’s settlement or outright reject it. This could happen even if you’re claiming from your own insurer.

Being represented by an attorney gives you more negotiating power when facing experienced insurance companies. Your lawyer should also help you avoid common mistakes that could damage your case. Even if you’re not planning to file a lawsuit, consult with a personal injury attorney to determine your best next steps.

Should you talk to a lawyer after a car accident?

Yes, contacting a lawyer is a crucial step immediately after a car collision. It’s best to call a trusted personal injury attorney as soon as possible, even before you speak with any insurance company (even your own insurer).

Insurance companies will try to get a recorded statement from you, which they could use to harm your claim and diminish your settlement value. Before you call your insurer to notify them of the crash, and before you speak with the other party’s insurer, consult your lawyer or have them represent you.

How do you choose an attorney for an accident in New Jersey?

These are the top qualities you should look for in a personal injury lawyer:

- Extensive experience in the field – More than a law degree, look for a lawyer’s experience in personal injury cases. The more firsthand experience they have, the more familiar they are with insurance tactics and negotiation dynamics. Also, check if they have won cases similar to yours.

- Industry recognition – The legal industry’s rating systems and professional associations help tell you about upstanding attorneys in the field. For instance, under the prominent rating system of Avvo, a 10.0 rating means that a lawyer is “Superb” in terms of experience, professional discipline, and professional achievements. Look also for recognition from law organizations such as The National Trial Lawyers and the American Society of Legal Advocates (ASLA).

- Good feedback from former clients – Read testimonials from the attorney’s former clients to get an idea of the kind of treatment people receive from the firm. Also, find reviews from outside the attorney’s website, especially from your friends or family who have worked with them.

- Strong team and network – A personal injury claim is more effective if it has the support of investigators and expert witnesses. For instance, a neurologist could provide valuable testimony to bolster a nerve damage claim. Ask about the networks and associations of your potential attorney and about the doctors and experts who could support your case.

How long does a car accident lawsuit take in New Jersey?

There is no true average duration of car accident lawsuits because factors vary widely from case to case. A typical car accident litigation in New Jersey may take about a year or two, but some cases get resolved in as little as three days, while some stretch to more than three years.

The complexity of the accident is a major factor in the case duration. If the liability of the other camp is fairly obvious, the lawsuit could wrap up faster. But if there’s any reason for the defendant to deny responsibility or question any element of the claim, they will take that opportunity to argue.

Another factor is the court’s schedule itself. Court dates depend on the court’s caseload and docketing procedures. With a busy court, you can expect delays and longer waiting.

Note, however, that even if you’ve filed suit, there’s a possibility your case won’t go to trial. This can happen if you and the other party have arrived at a settlement before litigation begins. In fact, most personal injury lawsuits are settled before going to court. Further, even if court litigation has started, the case could be settled at any time.

To better understand lawsuit durations, read our overview of the injury lawsuit timeline.

How long does a car accident settlement take?

Settlement negotiations also vary widely depending on the unique combination of factors in the case.

One of the factors to consider is your maximum medical improvement (MMI), which is when you’ve recovered as much of your health as possible and no further recovery is expected. This is when we get a clear idea of all your past and future medical expenses related to the accident. Once you reach this stage, it is an ideal time to make an initial demand to the insurer and start the settlement negotiation.

Other factors that affect the settlement negotiation include the complexity of the accident, the severity of the injury, and any negligence on your part that contributed to the crash.

To learn how long settlement might take in your particular case, you’ll need to sit down with a lawyer for a case-specific assessment.

Contact an Experienced Car Accident Lawyer in NJ

The personal injury attorneys at Grossman Law Firm have earned the trust of New Jersey car accident survivors. Our top-rated firm has won millions for our clients in the last 20 years, helping them get back on track after their accident.

Your consultation with us is free. Talk to us about your car accident injury or if you have any concerns about your compensation claim. Call (732) 625-9494 today.